indiana tax payment voucher

You can find your amount due and pay online using the intimedoringov electronic payment system. Write your Social Security number on the check or money order.

Pin On Section 8 Housing Alerts

Enclose your check or money order made payable to the Indiana Department of Revenue.

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

. Know when I will receive my tax refund. Claim a gambling loss on my Indiana return. 430 pm EST.

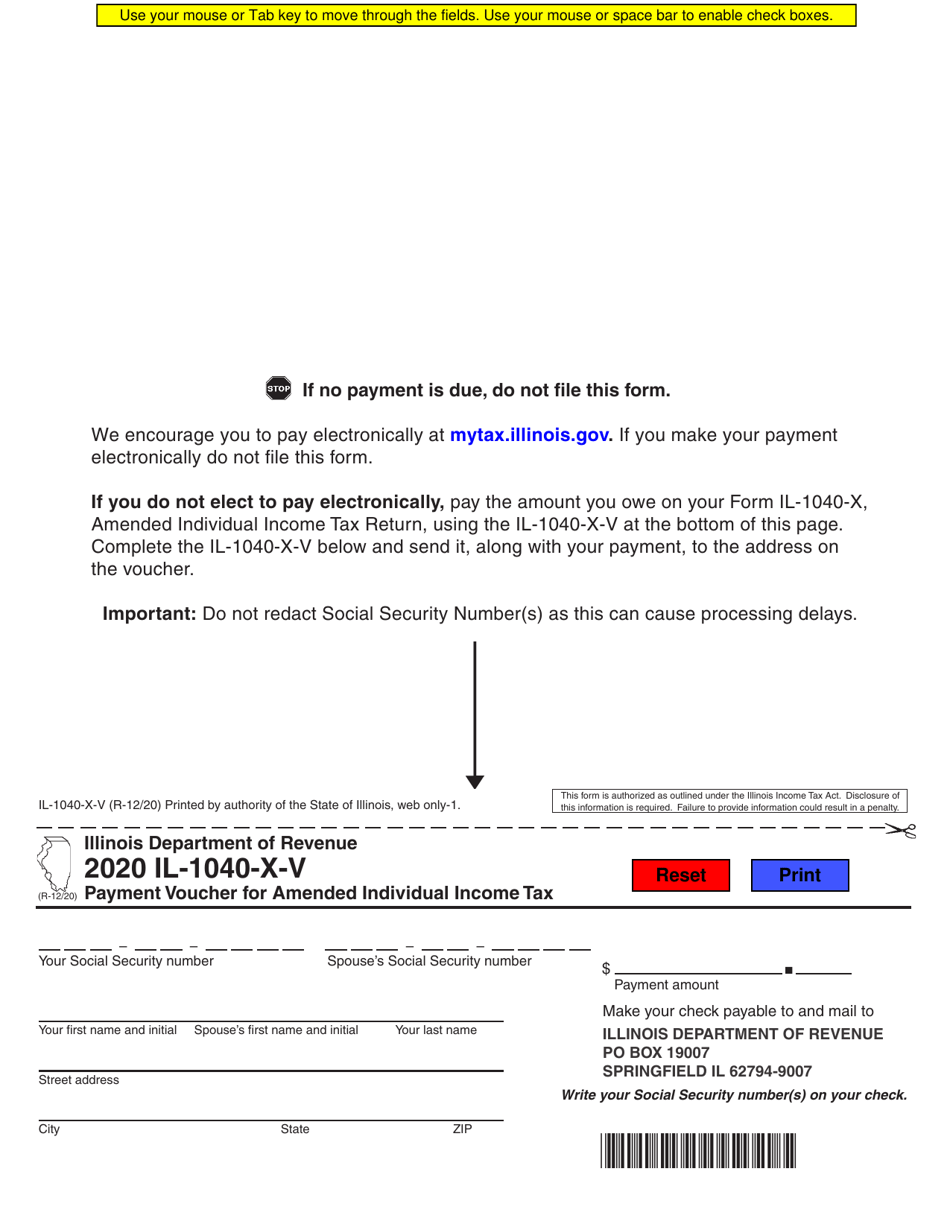

Please check the appropriate box on the front of this form to let us know if you are making an estimated extension or composite payment. To access this Payment Voucher from the main menu of the Indiana Fiduciary return select Miscellaneous Forms Total Payments Indiana Extension Voucher. When amending for tax periods beginning after 12312020 use Forms IT-40 IT-40PNR or IT-40RNR for that tax period and check the Amended box at the top right corner of the form.

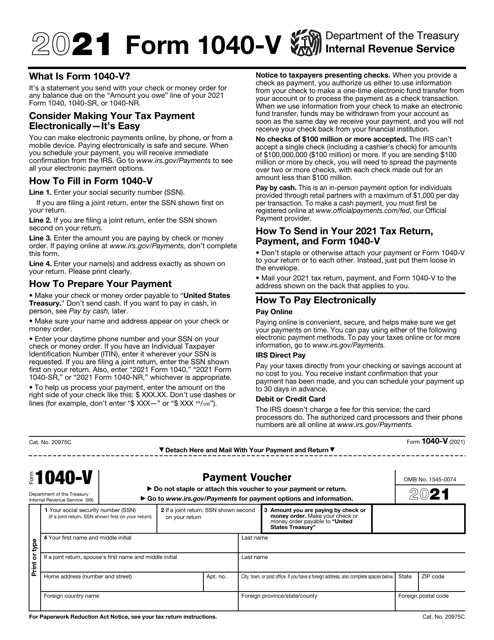

Indiana Department of Revenue PO. Submit this statement with your check or money order for any balance due on the Amount you owe line. For the 2022 tax year estimated tax payments are due quarterly on the following dates.

To pay by credit card you may make an estimated tax payment online. All payments must be made with US. Pay my tax bill in installments.

To pay go to wwwingovdor4340htm and follow the step-by-step instruc- tions. Box 7224 Indianapolis IN 46207-7224 Income Tax Returns Without Payment. Estimated Tax Payment Voucher.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Indiana government. We last updated Indiana Form ES-40 in January 2022 from the Indiana Department of Revenue. Have more time to file my taxes and I think I will owe the Department.

If you expect to receive a refund there is nothing to mail and the PFC will not print This form must accompany any payment you make to the Indiana Department of Revenue. Enter the amount of the payment to be made as an extension payment and mail it to the address on the form. Using TaxAct Indiana - Printing the Post Filing Coupon PFC Payment Voucher If you owe Indiana state taxes a post filing coupon PFC will print with your return.

Indiana estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates. Find Indiana tax forms. File Now with TurboTax.

You will be told what the fee is and you will have the option to either cancel or continue the credit card transaction. Indiana Amended Business Returns cannot be e-filed. To pay by using your American Express Card Discover Card MasterCard or VISA call 1-800- 2-PAY TAX 1-800-272-9829.

Have more time to file my taxes and I think I will owe the Department. Estimated Tax Payment Voucher. Fill in the form save the file print and mail to the Indiana Department of Revenue.

Form IT-41ES Indiana Department of Revenue Fiduciary Payment Voucher Estimated Tax Extension or Composite Payment State Form 50217 R10 8-20 For the calendar year or fiscal year beginning and ending Federal Employer Identification Number of Trust or Estate Name of Trust or Estate Name and Title of Fiduciary Trustee Executor Personal Representative. This form is for income earned in tax year 2021 with tax returns due in April 2022. Claim a gambling loss on my Indiana return.

Find Indiana tax forms. Enclose your check or money order made payable to the Indiana Department of Revenue. Pay the amount due on or before the installment due date.

To pay by credit card you may make your estimated tax payment online. This is in case the vouchers that are automatically issued after we receive your first payment dont get to you by the next payments due date. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Penalties for underpayment of estimated taxes. A convenience fee will be charged by the credit card processor based on the amount you are paying. Fiduciary representatives may use the IT-41ES Fiduciary Payment Voucher to make a payment for a trust or an estate.

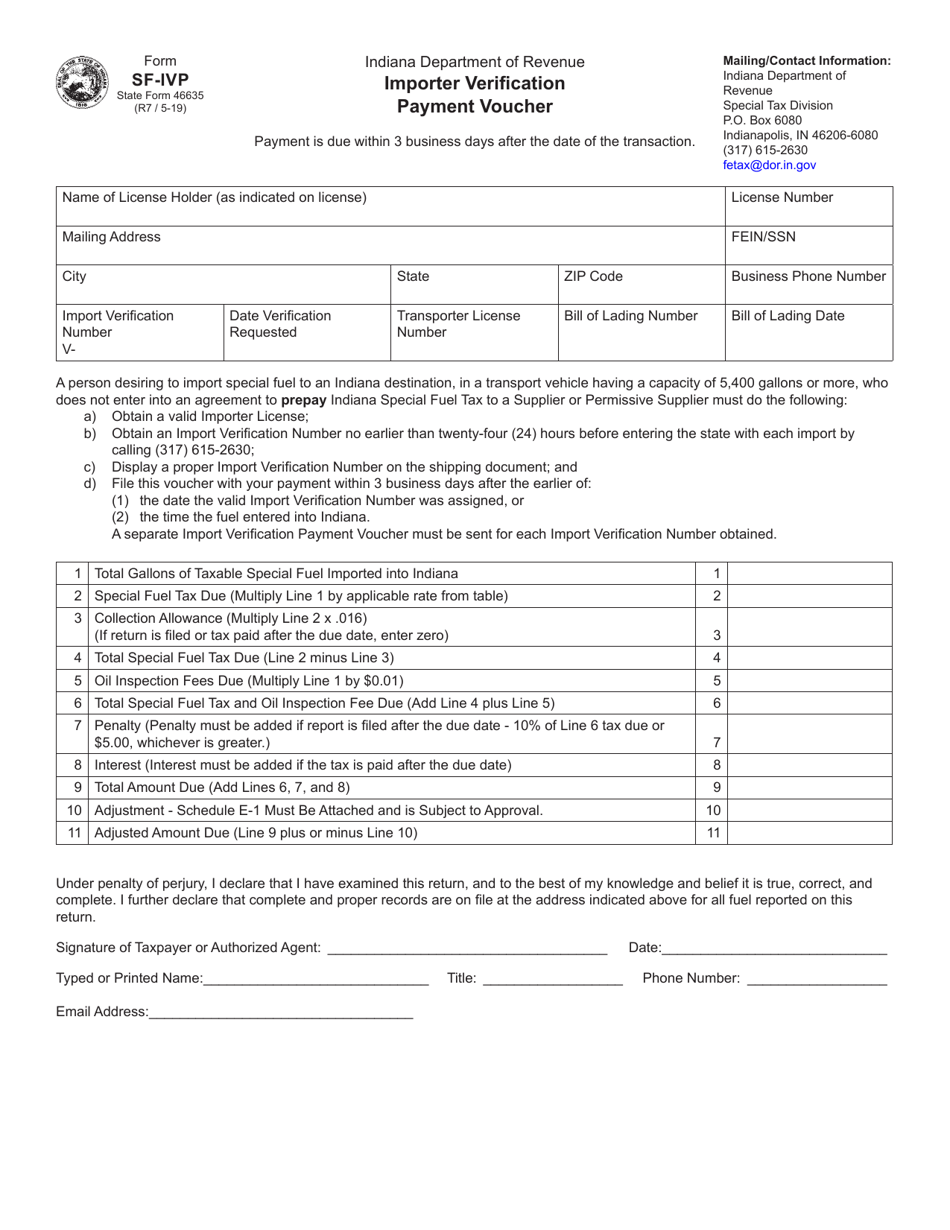

Name of License Holder as indicated on license License Number Mailing Address FEINSSN City State ZIP Code Business Phone Number Import Verification Number V-Date Verification Requested Transporter License Number. When you receive a tax bill you have several options. Write your Social Security number on the check or money order.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Since the change in your tax situation is not expected to repeat during the current year the estimated tax payments would not apply they are not a requirement just a suggestion based. The fee for using this service is 1 They also list a credit card option but nothing I see uses a voucher.

You will receive a confirmation number and should keep this with your tax filling records. Send in a payment by the due date with a check or money order. You can find information on how to pay your bill including payment plan options FAQs and more below.

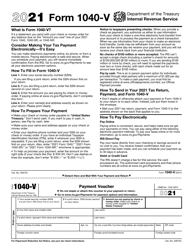

If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 8 am. Information about Form 1040-V Payment Voucher including recent updates related forms and instructions on how to file. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax Paying online Filling out ES-40.

Use this form to amend Indiana Individual Forms IT-40 IT-40PNR or IT-40RNR for tax periods beginning before 01012021. Form ES-40 State Form 46005 R22 12-21 Indiana Department of Revenue 2022 Estimated Tax Payment Form Your Social Security Number Spouses Social Security Number Your first name Initial Last name If filing a joint return spouses first name Initial Last name Present address number and street or rural route City State. Download Print e-File with TurboTax.

Mail entire form and payment to. You can print other. Take the renters deduction.

23 rows Page one of the Indiana Form ES-40 file is the fillable voucher for the 2021 tax year. Income Tax Returns With Payment Indiana Department of Revenue PO. Know when I will receive my tax refund.

Indiana Department of Revenue Importer Verification Payment Voucher Payment is due within 3 business days after the date of the transaction. All payments must be made with us. All payments must be made with US.

Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R22 12-21 Spouses Social Security Number Your Social Security Number Present address number and. To access this payment voucher from the main menu of the indiana fiduciary return select miscellaneous forms total payments indiana extension voucher. Estimated Payments Indiana does not require trusts and estates to make estimated payments.

Indiana payment vouchers No you are not required to pay the estimated tax vouchers for 2017 which were generated to assist with tax planning and avoiding tax penalties for the current year. Pay the amount due on or before the installment due date. Pay my tax bill in installments.

The item Form 8813 partnership withholding tax payment voucher section 1446 represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library. Take the renters deduction.

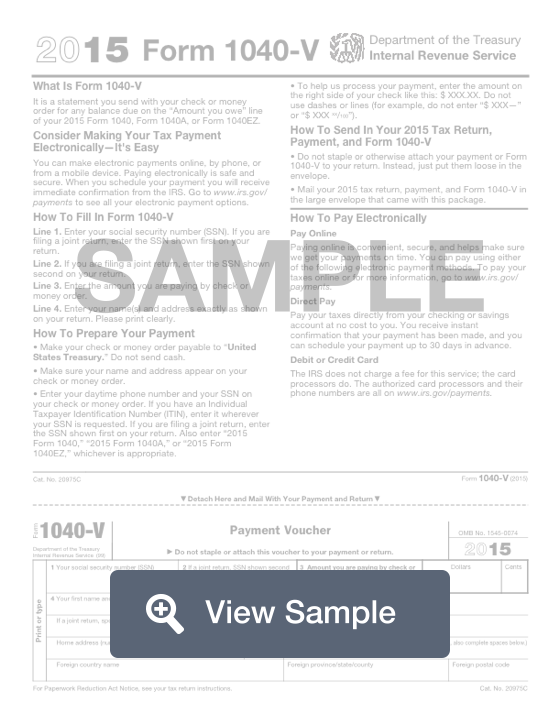

Form 1040 V What Is A 1040 V Fill Out Online Pdf Formswift

State Returns Estimated Tax Vouchers Direct Debit

Form Il 1040 X V Download Fillable Pdf Or Fill Online Payment Voucher For Amended Individual Income Tax 2020 Illinois Templateroller

Columbia Housing Authority In South Carolina Richland County South Carolina Columbia

/1040-V-df038816cc244b248641f447493a030d.jpg)

Form 1040 V Payment Voucher Definition

Download Instructions For Form St 103 Sales Tax Vouchers And Or Electronic Funds Transfer Credit Recap Pdf Templateroller

Form Sf Ivp State Form 46635 Download Fillable Pdf Or Fill Online Important Verification Payment Voucher Indiana Templateroller

Fiduciary Return Payment Voucher

Salary Slip Template Come In Handy If You Are In Charge Of Giving Salaries To Your Employee These Templates Make The L Salary Payroll Template Excel Templates

Indiana Estimated Tax Payments 2021 Fill Online Printable Fillable Blank Pdffiller

Irs Form 1040 V Download Fillable Pdf Or Fill Online Payment Voucher 2021 Templateroller

03 02 19 Alabama Housing Housing Authority Of The Birmingham District Is Open Http Www Habd Org Wp Content Uploads 2019 03 Mai List Birmingham Waiting List

Download Instructions For Form St 103 Sales Tax Vouchers And Or Electronic Funds Transfer Credit Recap Pdf Templateroller

Irs Form 1040 V Download Fillable Pdf Or Fill Online Payment Voucher 2021 Templateroller

Printable 2021 Indiana Form Es 40 Estimated Tax Payment Voucher