american working in canada taxes

Do Americans working in Canada pay Canadian taxes. Under Article XV of the Canada US Tax Treaty a US resident could be potentially subject to Canadian tax on the salary earned from a US employer.

Paying Employees In Canada And The Us What You Need To Know Smallbizclub

Canadian tax residency can occur.

. Tax return every year regardless of where they live or work. Employees working remotely in Canada may become tax residents of Canada and be subject to Canadian tax on their worldwide income. If an individual is present in.

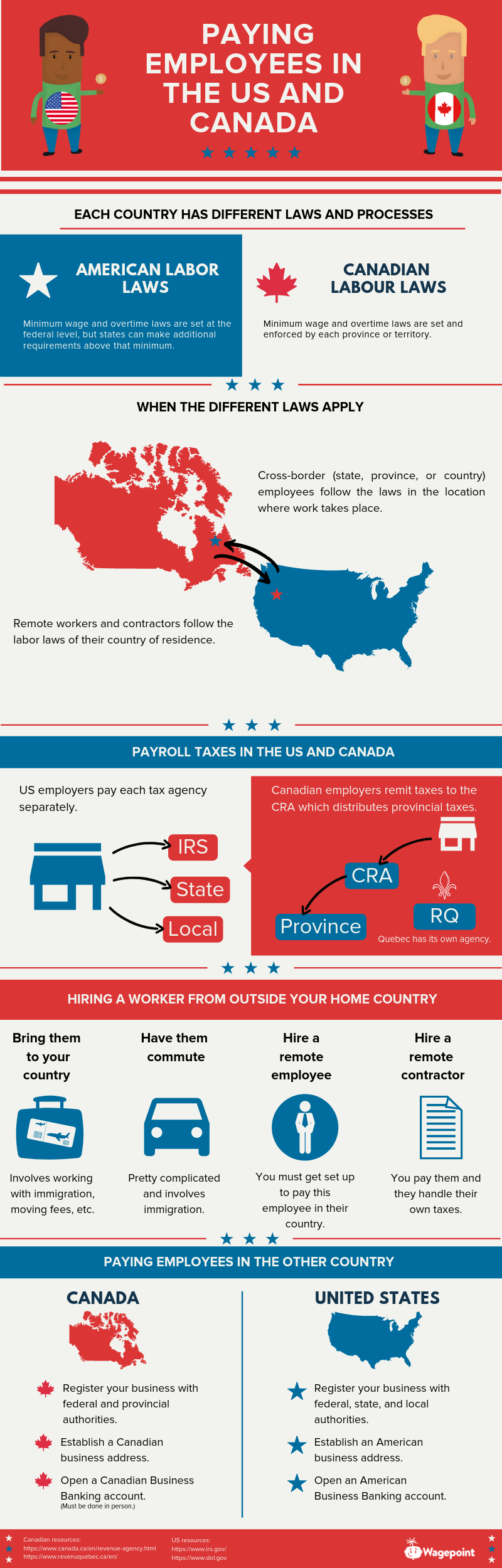

All Americans living abroad need to file a federal tax return each year if they make over the minimum filing thresholds 12000 for filing single 24000 for married filing. But this works only for employees working in the short duration of 90 days or less in a year. Canada and the United States both have federal taxes.

Some states have no state income taxes. Tax year starts January 1 and ends December 31. Do US citizens working in Canada pay taxes to both countries.

You should know the Canadian tax year is the same as the US. Citizens working in Canada may take advantage of one of two options detailed below to lower their taxes. Under both countries tax laws you may be obliged to file personal income tax returns for each.

Known as a Totalization Agreement the treaty establishes the country to which Americans residing in Canada should pay social security taxes depending on how long they. An American employee that is not a Canadian tax resident under Canadian law is required to only pay taxes on certain Canadian income. But theres a treaty agreement between the two countries that exempts an expat American citizen working in Canada from being taxed by the US.

The Foreign Earned Income Exclusion and Housing Exclusion The FEIE and. However under the income. As a USCanada dual citizen taxes can get tricky dual citizens.

Bases taxation on both your residence and citizenship status. This form works as a tax exemption form for all American employees engaged to work in Canada. Canadian taxes follow a.

Whereas all Canadian provinces have provincial tax. If you are an American citizen living in Canada your tax situation is delicate. Whats it like for.

Residents to work in Canada should ensure that Canadian withholding taxes are deducted and remitted to Canada. A non-resident is usually required to pay Canadian tax only on Canadian sources of income. On his Canadian earnings.

Employer with a fixed base in Canada who hires or transfers US. However in the US. Tax year but the filing deadline is different.

This means American citizens must file a US. Yes USCanada dual citizens file US.

Us Income Taxes For Canadian Businesses Which Forms To File

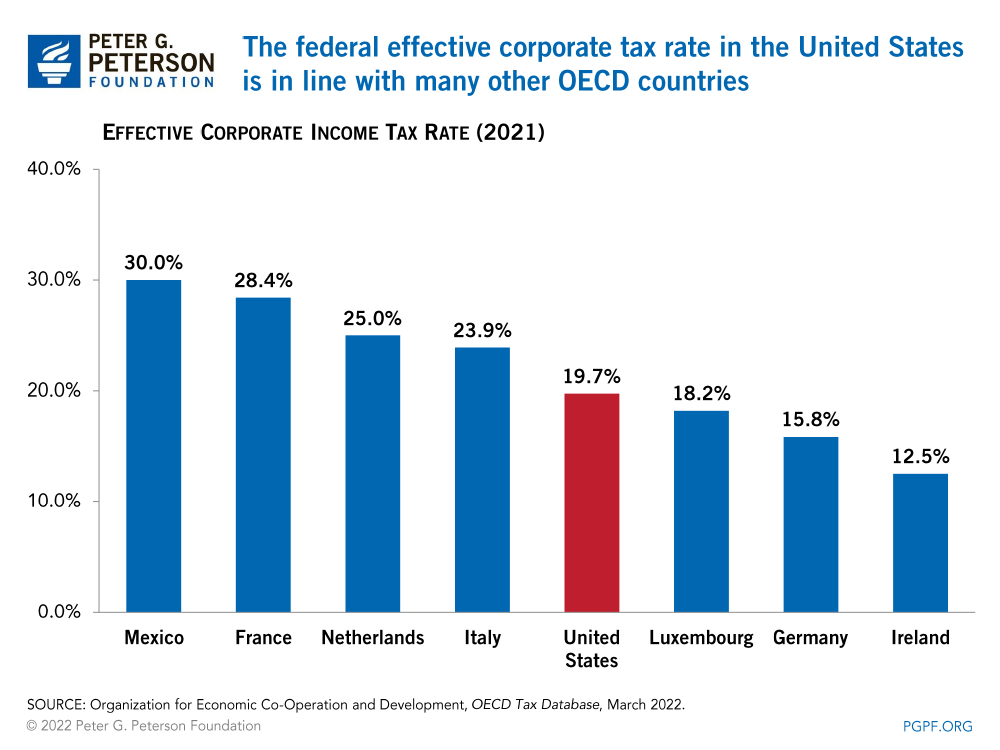

What Is The Difference Between The Statutory And Effective Tax Rate

Us Citizen In Canada With Tax Requirements Tax Doctors Canada Provides Canadian Tax Return Services To U S Citizens Tax Doctors Canada

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Us Expat Taxes For Americans Living In Canada Bright Tax

Canada Vs Usa Which Country Is Better To Settle For Indians In 2022

Americans In Canada Tax Implications You Need To Be Aware Of Crowe Soberman Llp

:max_bytes(150000):strip_icc()/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)

Canada Vs U S Tax Rates Do Canadians Pay More

Taxes And Financial Reporting For American Pro Athletes In Canada Far North Sider

Canada S Rising Personal Tax Rates And Falling Tax Competitiveness 2020 Fraser Institute

Tax Implications For Us Citizens Working In Canada Madan Ca

Sales Taxes In The United States Wikipedia

A Tax Guide For Americans In Canada Remote Swap

Canada S Personal Income Taxes On Highly Skilled Workers Now Among The Highest In Industrialized World The Nelson Daily

Simple Tax Guide For Americans In Canada

Americans Working In Canada And Taxes

Irs Releases Revised Information On The United States Canada Income Tax Treaty Withum

Tax Day 2017 How The Government Spends Your Tax Dollar Fortune

6 3 Explanation And Interpretation Of Article Vi Under U S Law Canada U S Tax Treaty Tax Professionals Member Article By The Accounting And Tax